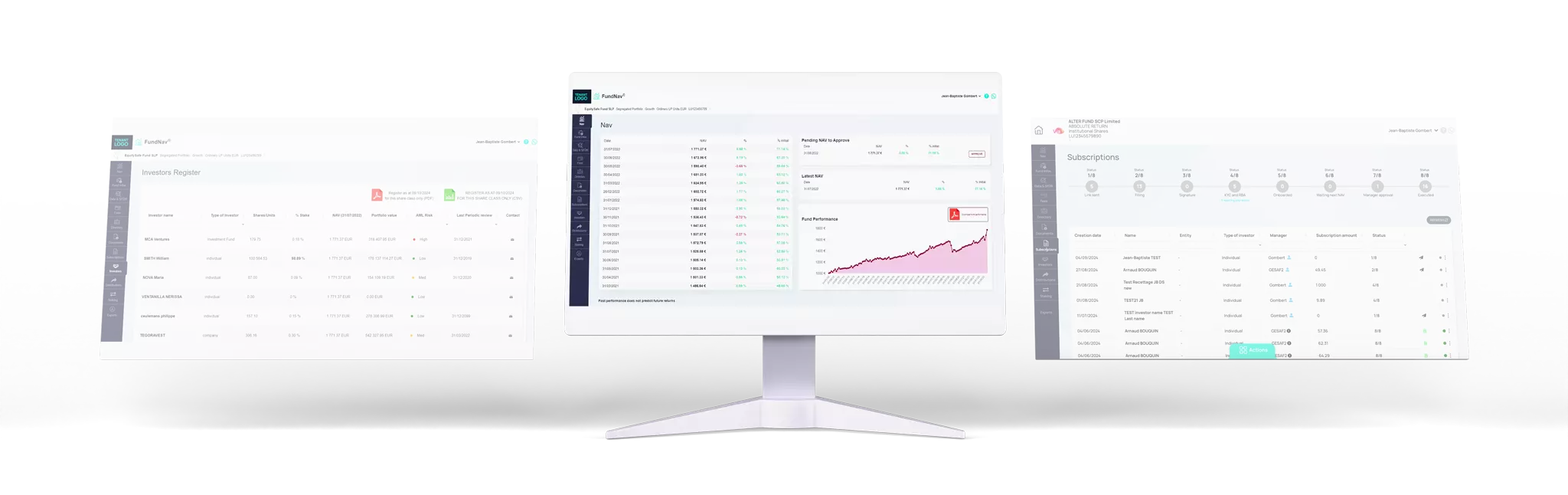

A fully digital reporting platform for fund managers and issuer to share information with their investors

FundNav® is an investor’s relation and communication hub which enables Fund Managers and Issuers to keep their investor updated on the information related to their investment, dematerialise onboarding process and 100% digital KYC, and allow investors to stake their assets.

Key Advantages

-

Simplify Investor Onboarding

-

Paperless Efficiency: Streamline your onboarding process with a fully digital solution

-

Faster Turnaround Times: Reduce processing time and improve overall efficiency

-

Enhanced Data Accuracy: Minimize errors and ensure data integrity

-

Improved Compliance and Security: Mitigate risks and adhere to regulatory requirements

-

-

Manage Shareholder Registry and KYC/AML Compliance

-

Digital Subscriptions: Simplify the subscription process for investors

-

Mitigate Risks: Implement robust KYC/AML checks to identify and prevent fraud

-

Online Verification: Utilize digital signatures and ID checks for efficient verification

-

Legal Compliance: Ensure adherence to legal obligations and sanction lists

-

Continuous Monitoring: Conduct periodic reviews and risk-based assessments

-

-

Efficiently manage Capital Calls for Closed-Ended Funds 24-7

-

Automated Capital Calls: Prepare and send capital calls to investors effortlessly

-

Online Verification: Track and verify defaulting investors for timely follow-up

-

-

Empower investors with Peer-to-Peer Trading

-

Active Staking: Allow investors to buy or sell shares, units, or notes

-

New: Tokenisation of securities with FundNav®

For Units, shares, Interest in Partnership, Notes, Bonds,…

Issuance of security tokens on the blockchain

See how FundNav® drives your success

Every feature is designed to boost efficiency for fund administrators and enhance satisfaction for fund managers

FundNav® is an innovative digital platform that streamlines investment management.

Its user-friendly interface makes onboarding investors quick and easy, while ensuring the highest standards of security and regulatory adherence.

Multi Issuance

FundNav allows issuance of several share classes, Interests in partnerships, series and tranches of Notes, units of mutual funds, bonds, trackers, Actively Managed Certificates, zero bonds, and any other categories of securities.

Multi managers

Easily scalable from one manager up to 100 managers active per management company or general partner.

Transparent investments

Provides investors with information/documents about their position or participation or interest in an investment fund.

Fully digital onboarding

Enables faster turnaround times, enhanced data accuracy, and improved compliance/security measures, sanction list, digital risk based assessment.

Managements of Series and Tranches

Easily organize and track series and tranches.

Management of Subscription Fees per investor

Track and manage investor subscription fees or Equalisation factors with ease, adaptable per investor/subscription.

Multi Security : Notes, Shares, Units, Bonds and others

Manage various securities in a single platform.

Multi currency

Handle transactions across multiple currencies effortlessly, including subscription in crypto assets.

FundNav® integrates perfectly with other Funds365® services to form a comprehensive suite of fintech services.

Other Services

Library and Directory

Easy access contact information and legal ressources provided by the Administrator

Compares FundNav® with current onboarding processes and tools

| FundNav | Subscription on paper | |

| Dematerialised | ||

| Speed of onboarding | ||

| Lower costs | ||

| Better KYC experience | ||

| Log of transaction | ||

| Online execution and approval | ||

| Contract Note issued automatically | ||

| Automatic register update |